Canada’s Jobless Rate Returns To 40-Year Low

Statistics Canada announced this morning that Canada’s jobless rate returned to a four-decade low as job growth rebounded, confirming that the jobs market is at or near full-employment. Canada added 15,400 net new jobs last month as the unemployment rate edged downward to 5.8%, its lowest level in records back to 1976. This follows January’s 88,000 job loss. However, the gains reflected a rise in part-time employment, which was up 54,700. Full-time jobs were down by 39,300, a reversal in the January performance and the first time in five months that full-time employment has fallen. Full-time positions have been responsible for most of the boom in jobs in the past year and a half, jumping by nearly 500,000 net new ones over that period.

Statistics Canada announced this morning that Canada’s jobless rate returned to a four-decade low as job growth rebounded, confirming that the jobs market is at or near full-employment. Canada added 15,400 net new jobs last month as the unemployment rate edged downward to 5.8%, its lowest level in records back to 1976. This follows January’s 88,000 job loss. However, the gains reflected a rise in part-time employment, which was up 54,700. Full-time jobs were down by 39,300, a reversal in the January performance and the first time in five months that full-time employment has fallen. Full-time positions have been responsible for most of the boom in jobs in the past year and a half, jumping by nearly 500,000 net new ones over that period.

Wage growth decelerated to 3.1% in February, after hitting 3.3% a month earlier, its fastest pace since 2015. Salary gains were boosted last month by the Ontario hike in minimum wages.

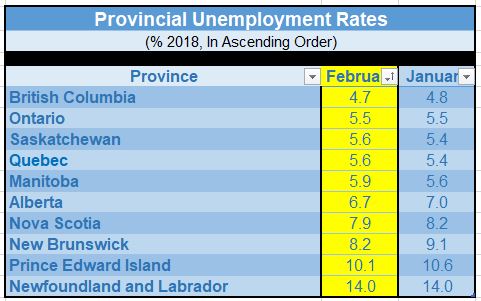

Ontario recorded the most substantial monthly drop in employment in January (down 50,900) on the heels of the wage hike. The province led job growth in February but made up only a small part of January’s loss with only 15,700 net new jobs. Employment was also up in New Brunswick and Nova Scotia, while it decreased in Saskatchewan and was little changed in B.C. Of note, Alberta’s unemployment rate fell to 6.7%, a 1.5 percentage point decline over the past year, as the provincial participation rate fell slightly in February.

The bulk of the gains were in the public sector (+50,300), while the private sector added 8,400 net jobs. Holding back the overall pace of gains was a decline in self-employment, down 43,300 in February after four months of net increases.

The gain last month was driven by services-producing industries, particularly health care and education. Manufacturing recorded a loss of 16,500 workers during the month. The number of people working in natural resources rose 7,600 in February, bringing the year-over-year employment growth to 3.4%. Employment in this industry has been trending higher since the second half of 2016.

The finance, insurance, real estate, rental and leasing industry–heavily impacted by the slowdown in housing–experienced a drop in employment of 12,000 last month, posting no growth on a year-over-year basis.

Today’s employment release is consistent with Canadian growth of roughly 2.0%. The February net gain of 15,400 is probably about what we can expect on average this year as the economy bumps up against full capacity. At 3.1% in February, wage growth posted a fourth consecutive month above its longer-term average of 2.6%. This will not set off inflation warnings at the central bank as the Bank of Canada reported this week that it still assesses wage growth to be below what is normal in an economy without labour market slack. This suggests the Bank will maintain its cautious stance.

U.S. Jobs Strong As Wage Gains Slow

U.S. nonfarm payrolls surged 313,000 in February compared to an expectation of a 200,000 net gain. Gains were mainly in the private sector and upward revisions to the prior two months added another 54,000 jobs. The jobless rate held at 4.1%–the fifth straight month at that level–as increased numbers of new workers entered the labour force. Rising labour force participation rates–reflecting the reentry of discouraged workers–might be one factor holding down wage gains.

Wage growth, which rose a moderate 0.2% month-over-month in February, dipped on a year-over-year basis to 2.6% from a level of 2.8% the prior month. Still, wages have risen at a 3.0% annualized pace over the past three months. The sharp pay gains spooked the markets last month but are apparently not yet taking hold.

Today’s jobs release signals the U.S. labour market remains strong and will keep driving economic growth, while the wage figures show some cooling from a pace that spurred financial turbulence last month on concern that the Federal Reserve could raise interest rates faster. The unemployment rate remains well below Fed estimates of levels sustainable in the long run.

The new Federal Reserve Chairman Jerome Powell will debut at his first Federal Open Market Committee Meeting March 20-21. The question market participants are mulling over is whether central bank officials will hold to projections of a total of three rate hikes this year, or boost the outlook to four.

President Donald Trump has said the tax-cut legislation he signed in December would spur economic growth and boost jobs and wages. At the same time, his tariffs on steel and aluminum imports may become a headwind depending on how extensively they’re implemented and how other nations retaliate. Canada can breathe a sigh of relief for now as Trump made a last-minute turnabout to exempt US NAFTA partners from the tariffs. The president struck an unusually optimistic tone on the fate of NAFTA but repeated his threat to quit the pact if the talks fall short.

“Today is a step forward,” Chrystia Freeland, Canada’s foreign minister, told Bloomberg News in Toronto Thursday. She said Canada would push “until the prospect of these duties is fully and permanently lifted,” and said it would be inconceivable to apply tariffs to a close military ally like Canada on national security grounds.